How the internet has changed the way we send each other money

The internet transformed how people manage their finances. Online banking was a big leap, and the most recent shift has been in sending and receiving money from almost anywhere in the world instantaneously.

Uniqode compiled a list of ways the internet has altered how money changes hands. Though hard currency, in one form or another, has been around for more than 5,000 years—and bartering before that—most money today exists in electronic form. This was true even before the COVID-19 pandemic encouraged more people to find ways to send and receive money without leaving their homes. And those who did venture out often wanted to avoid handling cash—and the germs that might be on it.

By the end of 2020, nearly half of Americans had used a mobile wallet, which allows for contactless digital payment. In 2022, more than four in five American adults owned a smartphone and used it as a constant companion.

Electronic payment systems such as Venmo, Zelle, Apple Pay, Google Pay, cryptocurrency, e-wallets, and others continue to gain popularity.

By 2030, the number of dollars exchanged in cashless transactions will nearly double in the US and Canada, and nearly triple worldwide, according to an analysis by financial services conglomerate PwC.

Faster transfers

It has never been easier or faster to send money around the world. Gone are the days of standing in line at the bank to deposit a paper check and then waiting for the money to be processed and added to your account.

The World Bank reports that two in three adults globally participate in online transactions, which are typically faster and more secure than cash exchanges.

In the US, sending funds electronically from one bank to another can take a few business days—or incur a cost for a wire transaction. However, several peer-to-peer services, including Zelle and Venmo, allow people to transfer money directly to and from each other’s bank accounts in minutes—or sometimes seconds.

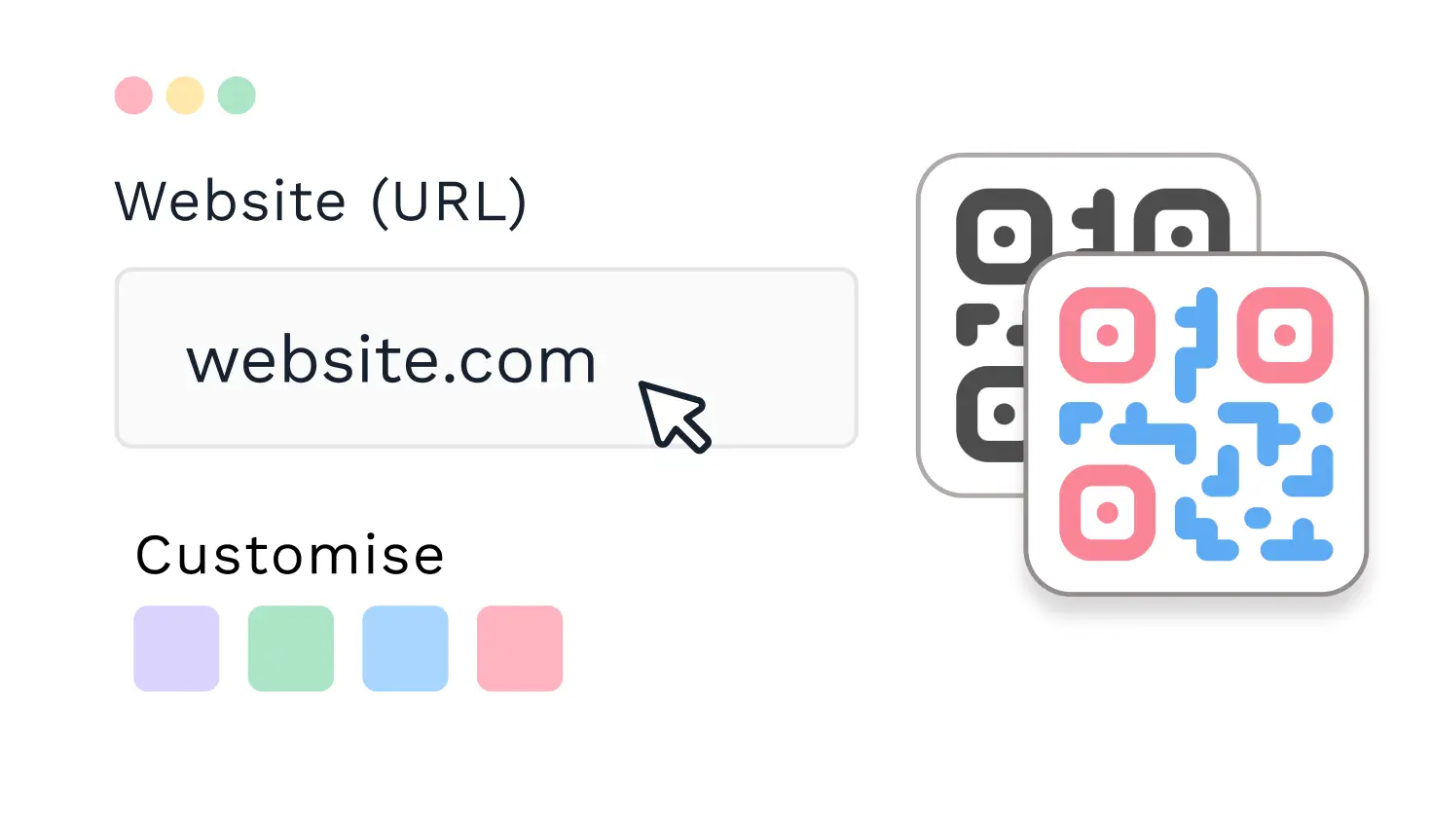

And in 2023, the Federal Reserve rolled out its own instant-transaction system called FedNow Service. Zelle made it easier to transfer money using QR Codes. One can scan a QR Code to auto-fill the recipient’s Zelle information to send money.

Simplification

Before the internet, when people wanted to send someone money, they had to meet in person to exchange cash or send a paper check through the mail, which took time to arrive and additional time before the funds were available in the recipient’s account.

Originally founded in 1998, PayPal was among the first companies to seek to turn those time-consuming and sometimes complicated personal transactions into electronic exchanges. It sparked an online banking revolution that now sees almost every bank with its own app, dozens of services for digital payments, and billions of people worldwide exchanging money electronically.

Consumers report that instant access to fraud alerts, credit checks, and daily banking transaction records has given them greater awareness and fewer concerns about their finances.

Though QR Code payments are not as popular as cash, credit, check, or wire, they’re increasing in popularity.

Variety of providers

Whether you’re a small business owner filing customer invoices, splitting a dinner check between friends, paying a babysitter, or sending remittances to family or friends outside the US, there’s an app for that.

Venmo, Paypal, Zelle, and Cash App are some of the most popular apps Americans use to send money via their phones. They tend to have different uses. Venmo is commonly used to send money between friends, store a balance in the app, and share transaction information on a social media-like feed.

Cash App can be used to invest in stocks and cryptocurrency. Zelle transfers funds directly between bank accounts. PayPal, which owns Venmo, also has its own payment app, which includes an option to pay in installments.

Automatic conversions

When people are traveling internationally or sending money to people in other countries, digital technology has made life much easier. In the past, banks and other service companies published regular lists of exchange rates, which often included large additional amounts to cover fluctuations and service fees.

But now, when changing, for instance, dollars to euros for people from the US heading to Europe, many digital payment apps, websites, and financial institutions convert the money automatically and instantaneously. Knowing in real-time how much their money is worth in other places can help travelers and businesses plan, budget, and spend responsibly.

Moving away from cash

Four in 10 Americans didn’t use cash at all in a typical week last year, according to a 2022 Pew Research Center study. Many said they didn’t even have cash on hand for an emergency, preferring to rely on digital or electronic payment methods instead.

Higher earners were generally less concerned with carrying cash than people who earn less, according to the Pew study. Using cash can avoid transaction fees or paying interest on purchases. And studies show that when people pay with cash, they are less likely to make impulse purchases.

However, if cash is lost or destroyed, it’s almost impossible to replace. Most online banking institutions offer customers protection against fraudulent charges. With that security, convenience, and less in-person contact in the era of a major pandemic, cash may have been king in the past, but it’s quickly getting replaced by electronic transactions.